Toko Kapital Introduction

12/27/2024

What is Toko Kapital?

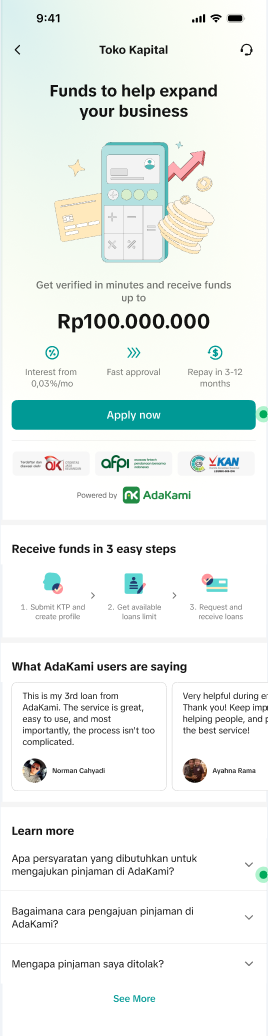

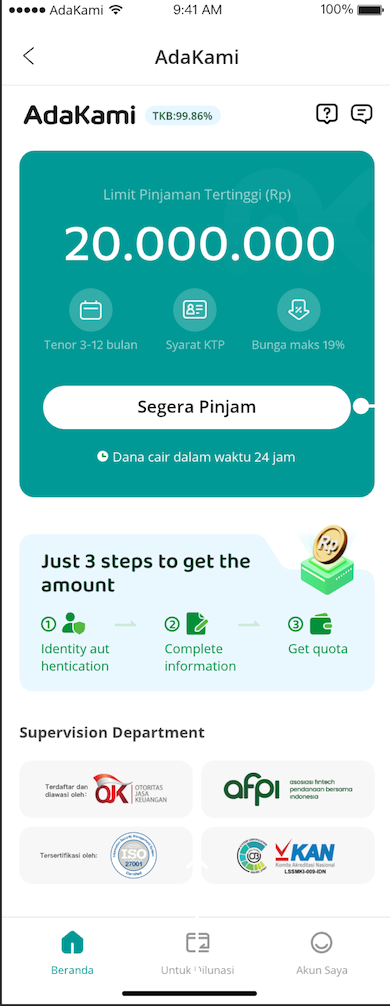

- Toko Kapital is the brand name of the financial loan service collaboration with Adakami designed to offer various types of loan products to e-commerce sellers.

- At present, we offer a Cash Loan product that allows sellers the flexibility to choose repayment terms of 3, 6, 9, 12 months, etc. The withdrawal and usage of funds are flexible, depending on the seller's preferences.

- The service is provided by Adakami, one of Indonesia’s largest peer-to-peer lending institutions. Adakami conducts the credit assessment and provides suitable credit limits based on the seller's sales performance.

- Estimated interest rate: approximately 0.1% per day.

- Credit limits range from Rp 1.5 million to Rp 300 million.

Who is eligible for Toko Kapital?

- Toko Kapital is available to selected sellers who meet the following criteria and pass the credit assessment:

| Criteria | |

| Registration time | >240days |

| Average GMV in the past 3 months | ≥ IDR 2,400,000 |

| **Non-blacklisted merchants (ATO/ junk registration/fraud/gambling/prohibited sale) | |

How to apply?

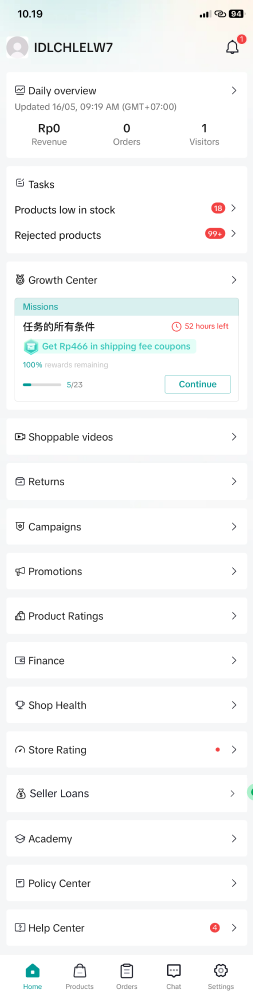

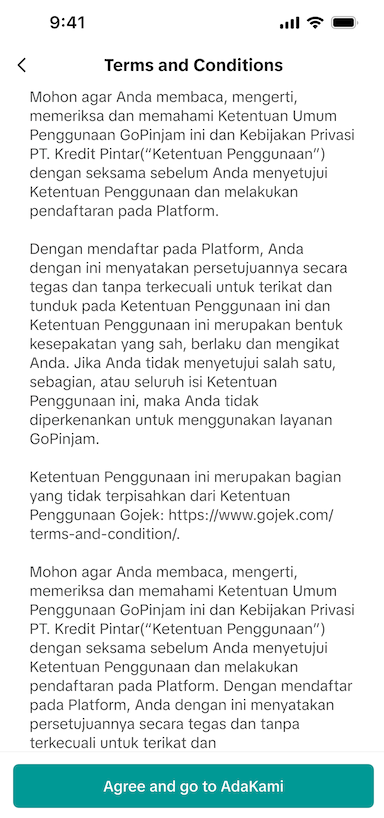

Entry

| Page 1 | Page 2 | Page 3 | Pag 4 |

|  |  |  |

|

|

|

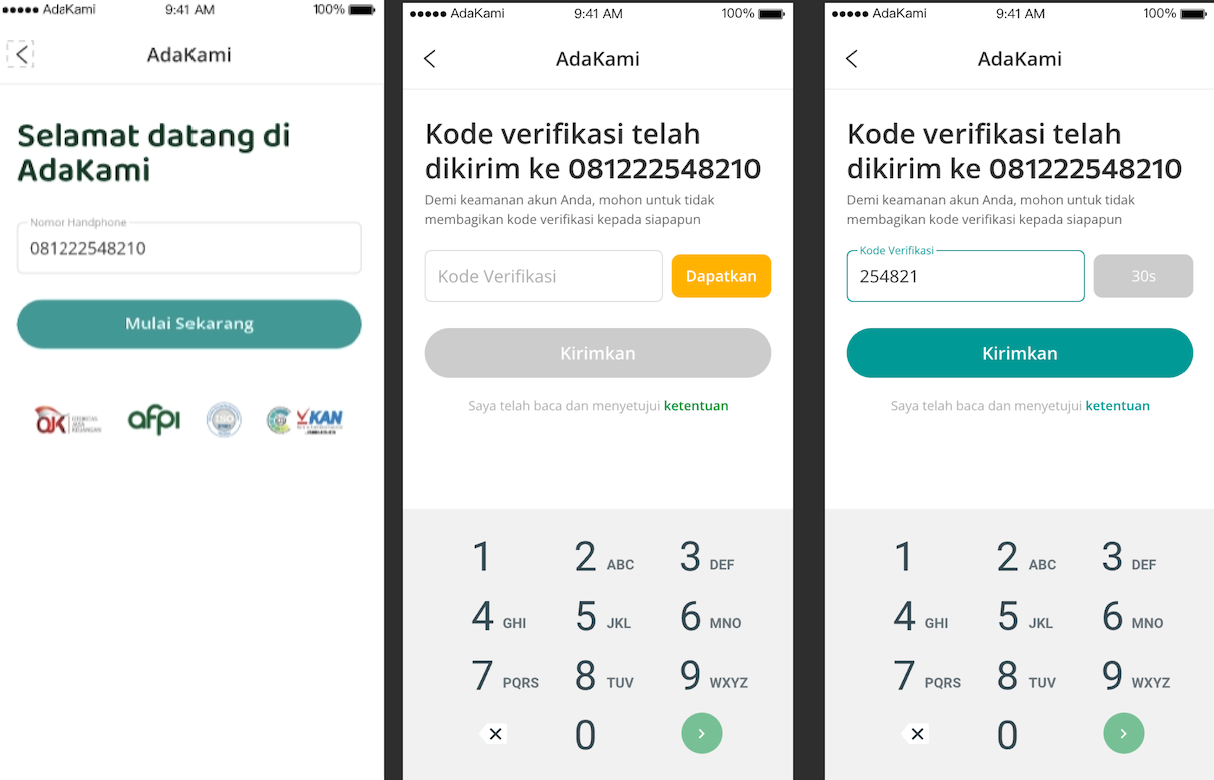

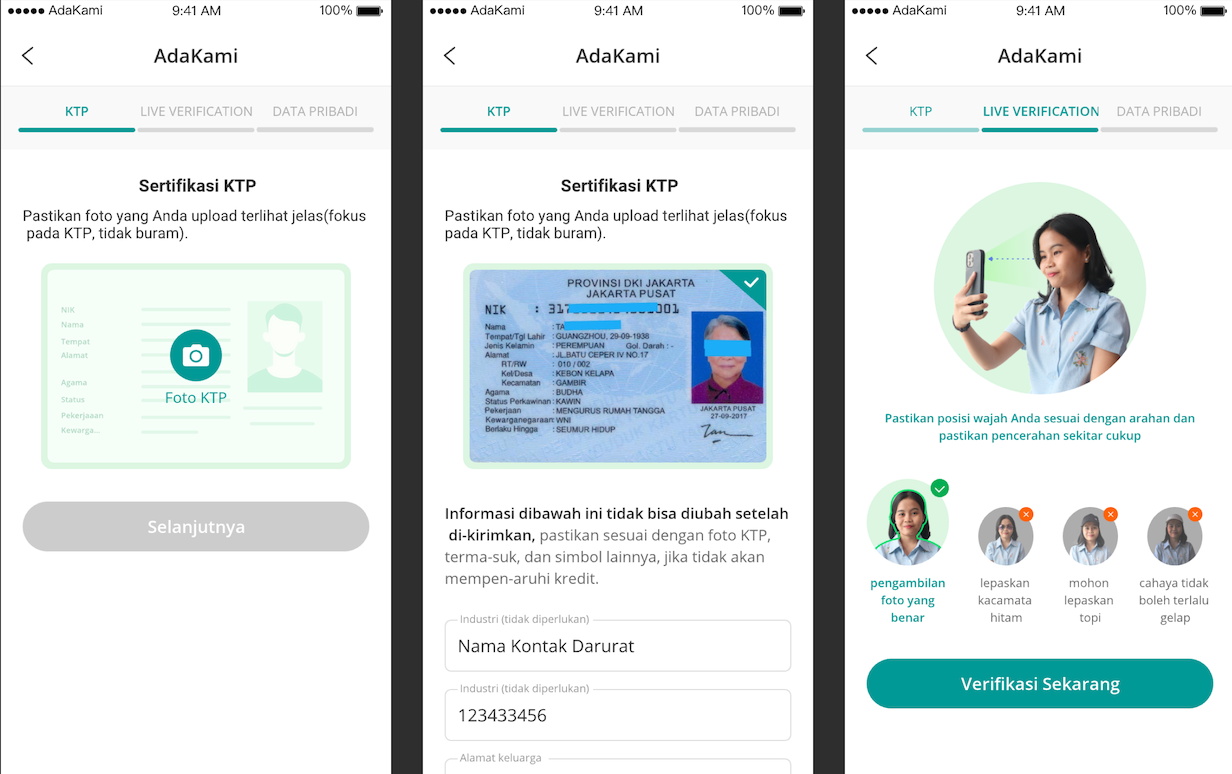

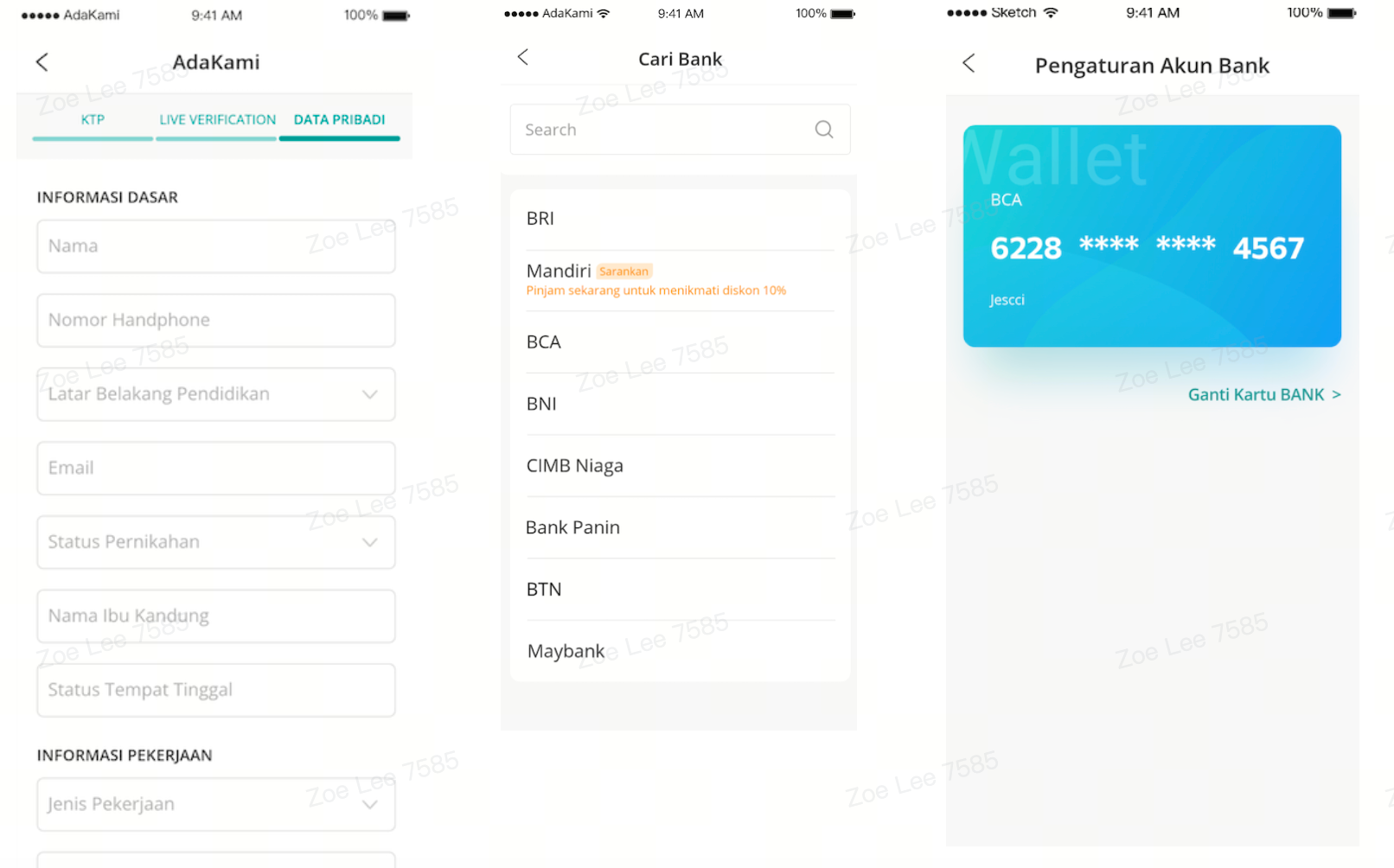

Application

| OTP Verification | KTP Upload and Liveness verification | Shop information and Card binding |

|  |  |

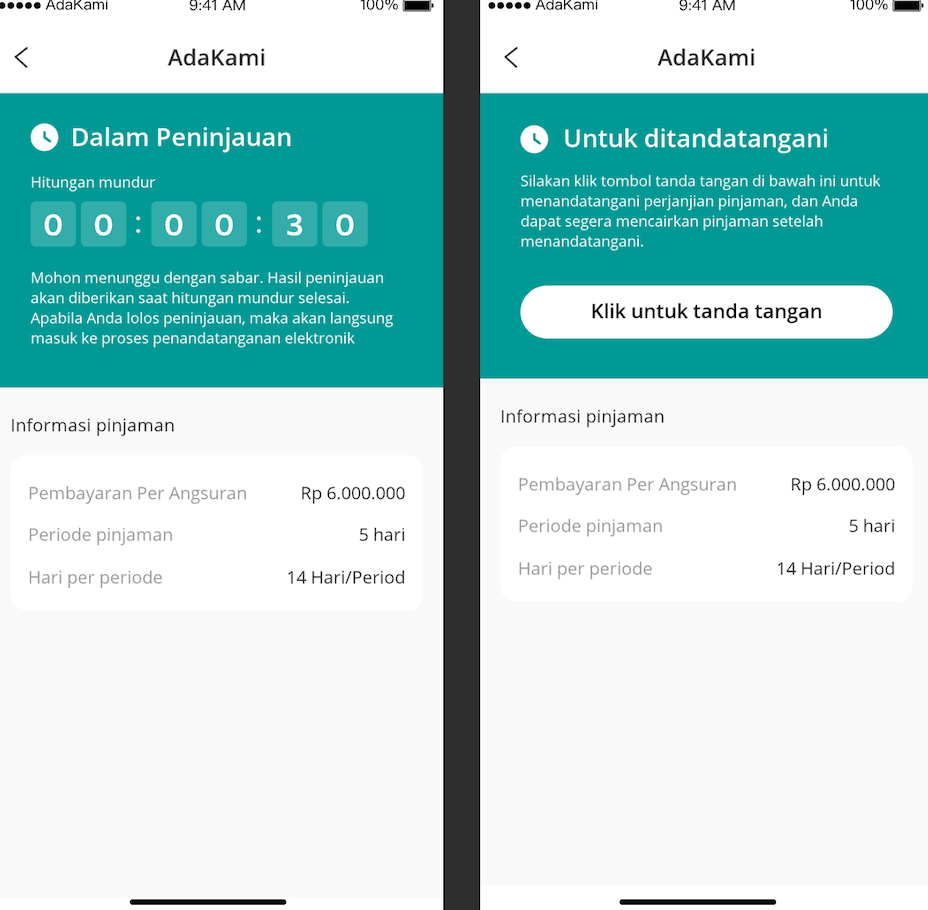

Withdrawal | Penarikan

| Choose Terms | Confirm and Withdrawal |

|  |

Scan to Apply

Please make sure the Seller App has been updated to 6.2.0 and above.

Please make sure the Seller App has been updated to 6.2.0 and above.